Overview of Nvidia’s H20 Chip Resumption

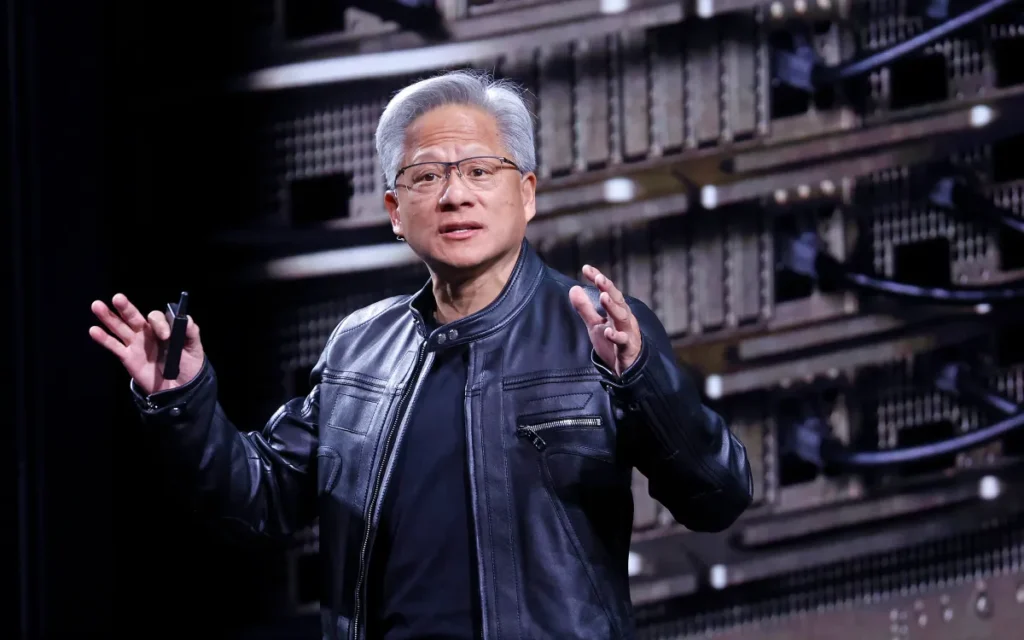

Nvidia has recently announced its decision to resume sales of its H20 artificial intelligence (AI) chips to China, a move that marks a significant pivot in U.S.-China tech relations. This announcement comes after a series of regulatory challenges that began during the Trump administration, which initially imposed stringent restrictions on semiconductor technology exports to China due to national security concerns. These limitations were aimed at curbing China’s technological advancements in critical sectors such as artificial intelligence and high-performance computing.

The timeline leading to the resumption of H20 chip sales can be traced back to integrative dialogues and negotiations that took place between U.S. officials and representatives from Nvidia. Following a series of meetings that included discussions about compliance and potential impacts on the semiconductor industry, a reevaluation of the export restrictions was initiated. This shift indicates a change in the regulatory environment as the Biden administration appears to be adopting a more nuanced stance regarding the techno-economic relationship with China.

Nvidia’s position in the AI industry is pivotal, as it is one of the leading providers of GPU technology that powers AI applications, making this resumption a notable development. By resuming chip sales to China, Nvidia not only aims to expand its market presence but also addresses the growing demand for sophisticated AI solutions in one of the world’s largest technology markets. The implications of this decision are profound, as it reflects Nvidia’s strategic efforts to navigate the complexities of international trade while harnessing the potential of AI in various sectors of the Chinese economy.

This resolution symbolizes a crucial juncture in understanding the balance between regulation and commerce in the evolving landscape of global technology competition, with Nvidia playing a vital role in bridging the technical capabilities of the U.S. and China’s AI ambitions.

The Regulatory Landscape and Its Impact

The regulatory environment surrounding semiconductor sales, particularly to China, has become increasingly intricate, especially regarding high-performance chips such as the Nvidia H20. In October 2022, the U.S. government announced a series of restrictions aimed at limiting China’s access to cutting-edge technologies, which include advanced semiconductors. These regulations were primarily motivated by national security concerns, as U.S. officials argue that sophisticated technology could bolster China’s military capabilities and enhance surveillance capabilities.

The performance thresholds imposed by the U.S. government significantly impact Nvidia’s ability to penetrate the Chinese market effectively. With stringent criteria defining which chips can be sold, Nvidia has had to modify its offerings to comply with these regulations. This has resulted in delays for new products and has complicated its engagement with Chinese tech corporations eager to leverage high-performance computing for advancements in artificial intelligence and data analysis. The regulatory hurdles not only challenge Nvidia but also stymie innovation within the Chinese tech sector, as companies may find themselves unable to source essential components.

This landscape has also drawn criticism from various stakeholders. U.S. policymakers argue that the ever-competitive tech rivalry has created a need for such stringent measures to ensure national security. Conversely, some analysts contend that these regulations may negatively impact American companies. The restrictions could result in lost market opportunities and diminished revenue, particularly as China continues to push for self-sufficiency in technology. The intricate web of regulations emphasizes the delicate balance policymakers face—protecting national interests while fostering technological collaboration, which remains crucial for global innovation.

Nvidia’s Strategic Moves and Market Response

Nvidia has been navigating a challenging landscape due to changing regulatory frameworks, particularly concerning its business dealings in China. In response to these dynamics, the company has made strategic maneuvers to adapt to the evolving market conditions. A key development is the introduction of the new ‘RTX Pro’ chip, specifically designed to cater to the needs of the Chinese market while ensuring compliance with U.S. regulations. This chip comes equipped with features that restrict certain capabilities deemed sensitive under current U.S. trade restrictions, thereby allowing Nvidia to maintain access to a significant segment of the Chinese electronics market.

Furthermore, the reaction from Chinese tech firms has been noteworthy. Many local companies had engaged in stockpiling chips in anticipation of tighter controls from the U.S. government. This proactive approach reflects a sense of urgency among these firms to secure their supply chains in the face of potential shortages. As a result, the demand for Nvidia’s ‘RTX Pro’ chip could be substantial, especially given the critical role that advanced graphics processing units play in sectors ranging from artificial intelligence to gaming and data centers in China.

Simultaneously, Nvidia’s strategy extends beyond its immediate response to regulatory challenges. The company is also focusing on expanding its investment within the U.S. tech ecosystem, seeking to bolster its domestic market position while navigating the complexities of international trade. By doing so, Nvidia aims to create a balance in its operations that minimizes risks associated with regulatory fluctuations. Overall, the interplay between Nvidia’s strategic adaptations and the reactions from Chinese tech players highlights the intricate dynamics of the global semiconductor industry in an era of increasing scrutiny and regulation.

Future Outlook of AI and Chip Sales in Global Markets

The future of AI and chip sales in global markets remains a complex and evolving landscape, particularly in light of Nvidia’s recent decision to resume sales to China. This move raises important questions about the implications for the AI industry amid increasing regulatory challenges and the ongoing technological rivalry between the United States and China. By re-entering the Chinese market, Nvidia positions itself to capture significant market share in one of the world’s largest AI ecosystems, but it also invites scrutiny from international regulators worried about technology transfer and dual-use applications.

The implications of continued regulatory fluctuations will likely shape the trajectory of Nvidia’s growth and the broader AI market. As government regulations evolve, tech companies may have to navigate a fine line between fulfilling international demand for AI technologies and adhering to restrictions designed to protect national security interests. The possibility of sudden changes in trade policies could cause instability, necessitating agile adaptability from firms like Nvidia. Consequently, the fluctuations may lead to uneven growth patterns within the AI sector, compelling companies to diversify their markets or rethink their strategic alliances.

Moreover, as AI continues to permeate various industries, it is expected that global markets will witness an accelerated demand for chips designed specifically for advanced AI applications. Companies that invest in R&D to innovate and create more efficient, powerful chips will likely gain competitive advantages in an increasingly crowded field. However, the potential emergence of new challenges, such as supply chain disruptions or competition from other nations aiming to bolster their tech capabilities, may pose obstacles to sustained growth.

In conclusion, Nvidia’s decision to resume chip sales to China is a noteworthy development in the context of the global AI and chip markets. It highlights both opportunities and challenges, underscoring the necessity for tech firms to remain vigilant and adaptable amid dynamic regulatory environments and international rivalries.